Occupational Privilege Taxes in Colorado are essentially a “head tax” that is levied on most workers within jurisdictions that have the tax. Simply put, this means that every employee that falls under the requirements in the jurisdiction has to pay it, and there is typically an employer match of this tax. The tax is levied on a city and/or

tm2132889-15_s1a – block – 30.4845296s

Occupational Taxes. Five cities in Metro Denver assess an occupational tax on all people working in that city who earn a determined amount in monthly salary. Cities not on the list below do not assess an occupational tax. The occupational tax is shared by the employer and the employee, as indicated below: Metro Denver Occupational Taxes. City.

Source Image: auroragov.org

Download Image

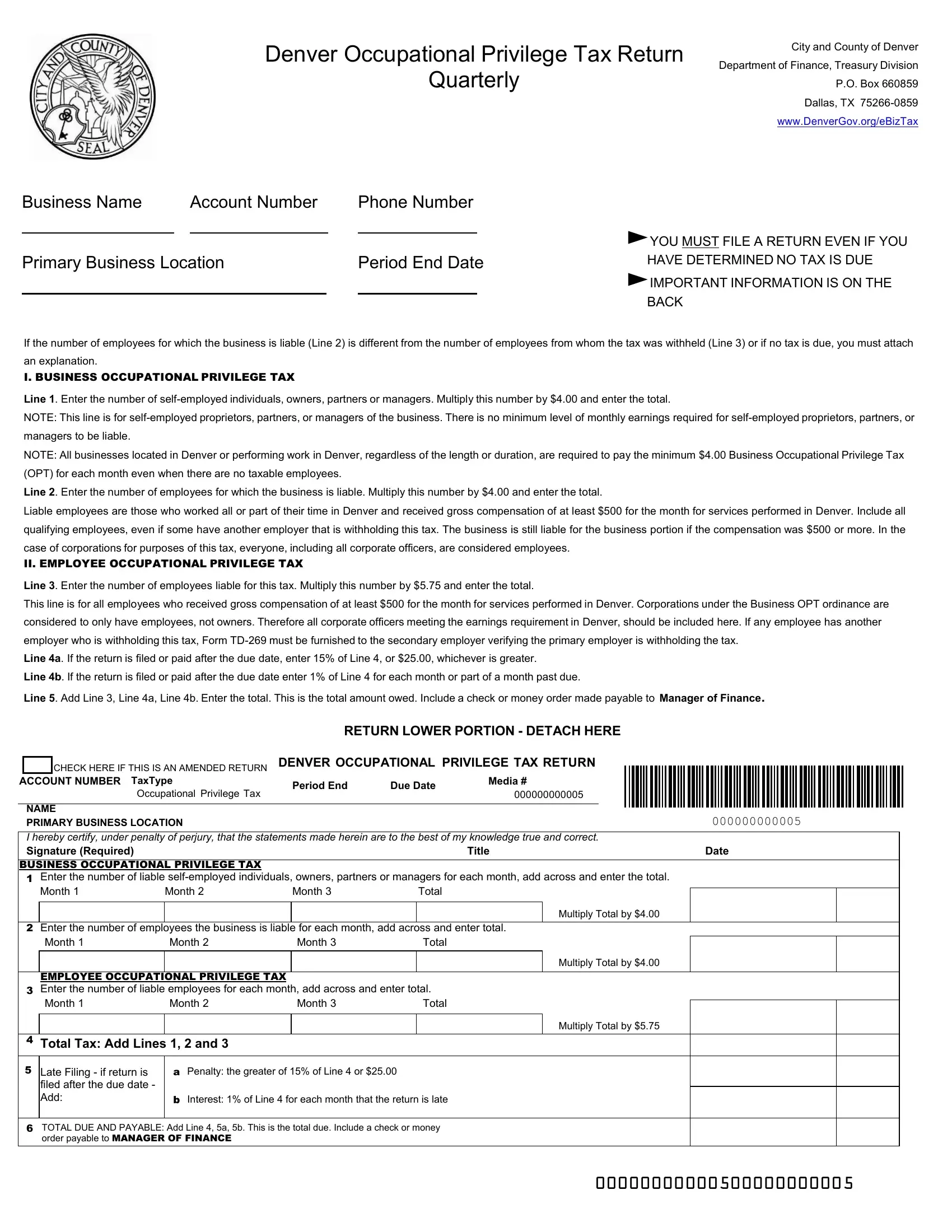

The OPT is made up of two parts or portions, those being the employee occupational privilege tax and the business occupational privilege tax. The OPT is imposed on businesses that

Source Image: formspal.com

Download Image

SEC Filing | Brilliant Earth Group, Inc. Transaction privilege tax (TPT) is another type of privilege tax in Arizona. This tax works kind of like a sales tax for sellers. TPT applies to certain purchases, and the seller is responsible for paying it instead of the customer. Arizona’s transaction privilege tax has a similar purpose as “regular” privilege tax: to tax a vendor for

Source Image: templateroller.com

Download Image

What Is The Denver Occupational Privilege Tax Used For

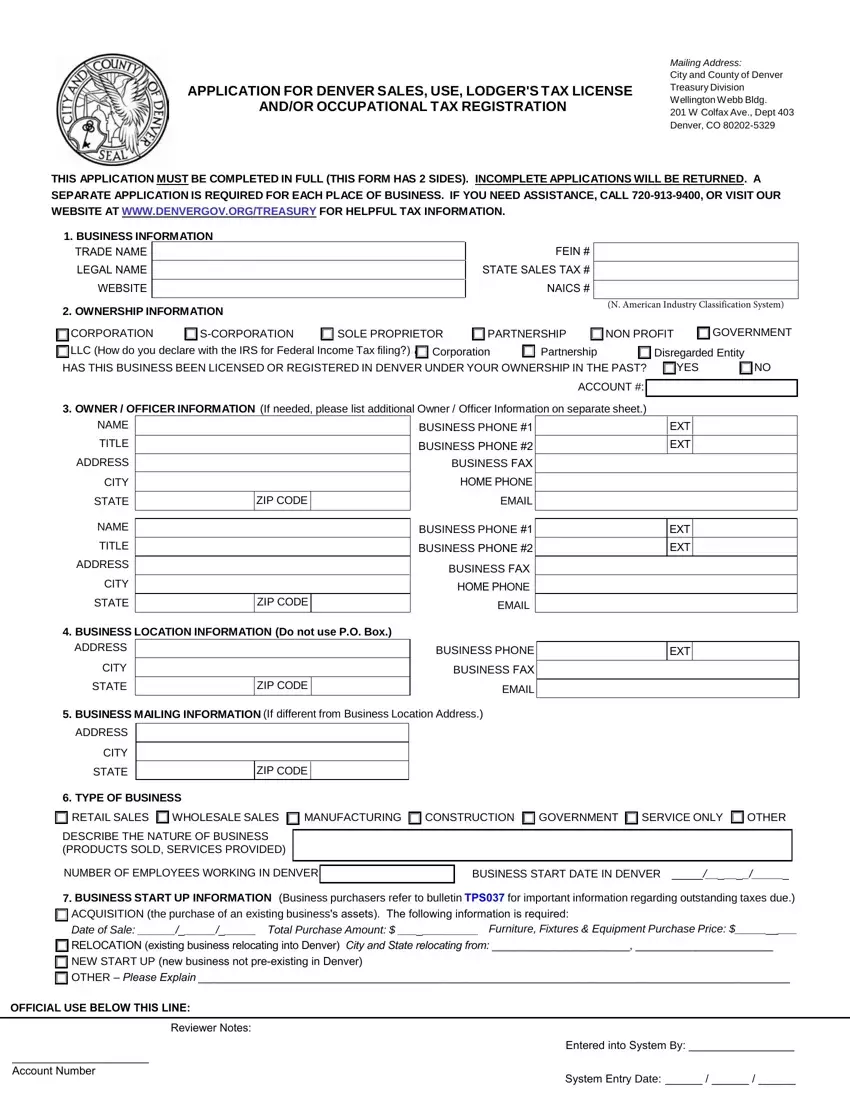

Transaction privilege tax (TPT) is another type of privilege tax in Arizona. This tax works kind of like a sales tax for sellers. TPT applies to certain purchases, and the seller is responsible for paying it instead of the customer. Arizona’s transaction privilege tax has a similar purpose as “regular” privilege tax: to tax a vendor for Sales Tax License. sales tax license is required for any retailer or vendor who is selling, leasing, or granting a license to use tangible personal property or taxable services to the user at retail within the City and County of Denver. Fee: $50.00 for each location per two-year period. Retailer’s Use Tax License.

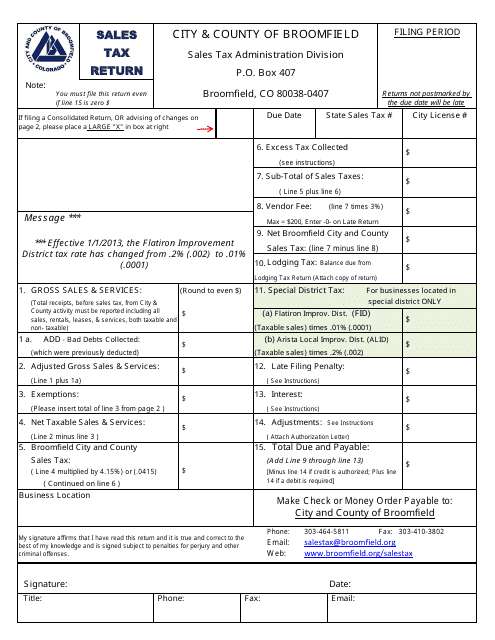

City and County of Broomfield, Colorado Sales Tax Return Form – Fill Out, Sign Online and Download PDF | Templateroller

Denver Occupational Privilege Tax (OPT) In Denver for example, an employee must pay $5.75 per month and their employer an additional $4.00 per month, just to have the “privilege” to perform work in the county. Denver has a $500/month wage threshold which must be reached to determine if the employee is considered taxable in a given month. The Vantage Blog – Caroline County Economic Development

Source Image: carolinebusiness.com

Download Image

CryptoPunkets #342 – CryptoPunkets | OpenSea Denver Occupational Privilege Tax (OPT) In Denver for example, an employee must pay $5.75 per month and their employer an additional $4.00 per month, just to have the “privilege” to perform work in the county. Denver has a $500/month wage threshold which must be reached to determine if the employee is considered taxable in a given month.

Source Image: opensea.io

Download Image

tm2132889-15_s1a – block – 30.4845296s Occupational Privilege Taxes in Colorado are essentially a “head tax” that is levied on most workers within jurisdictions that have the tax. Simply put, this means that every employee that falls under the requirements in the jurisdiction has to pay it, and there is typically an employer match of this tax. The tax is levied on a city and/or

Source Image: sec.gov

Download Image

SEC Filing | Brilliant Earth Group, Inc. The OPT is made up of two parts or portions, those being the employee occupational privilege tax and the business occupational privilege tax. The OPT is imposed on businesses that

Source Image: investors.brilliantearth.com

Download Image

Denver Occupational Privilege Tax PDF Form – FormsPal The $5.75 monthly deduction is for the City and County of Denver’s Occupational Privilege Tax, also known as a “head tax” to those familiar with business-related taxes. And the employers of Denver’s thousands of workers pay another $4.00 per month per employee, all to help the city and county provide services and keep its infrastructure

Source Image: formspal.com

Download Image

Understanding Disability Insurance for Doctors | White Coat Investor Transaction privilege tax (TPT) is another type of privilege tax in Arizona. This tax works kind of like a sales tax for sellers. TPT applies to certain purchases, and the seller is responsible for paying it instead of the customer. Arizona’s transaction privilege tax has a similar purpose as “regular” privilege tax: to tax a vendor for

Source Image: whitecoatinvestor.com

Download Image

2018 Black Book: 364 Executives to Know – Hawaii Business Magazine Sales Tax License. sales tax license is required for any retailer or vendor who is selling, leasing, or granting a license to use tangible personal property or taxable services to the user at retail within the City and County of Denver. Fee: $50.00 for each location per two-year period. Retailer’s Use Tax License.

Source Image: hawaiibusiness.com

Download Image

CryptoPunkets #342 – CryptoPunkets | OpenSea

2018 Black Book: 364 Executives to Know – Hawaii Business Magazine Occupational Taxes. Five cities in Metro Denver assess an occupational tax on all people working in that city who earn a determined amount in monthly salary. Cities not on the list below do not assess an occupational tax. The occupational tax is shared by the employer and the employee, as indicated below: Metro Denver Occupational Taxes. City.

SEC Filing | Brilliant Earth Group, Inc. Understanding Disability Insurance for Doctors | White Coat Investor The $5.75 monthly deduction is for the City and County of Denver’s Occupational Privilege Tax, also known as a “head tax” to those familiar with business-related taxes. And the employers of Denver’s thousands of workers pay another $4.00 per month per employee, all to help the city and county provide services and keep its infrastructure